If you’re a driver, you know that receiving a traffic ticket is never a good feeling. Not only do they come with hefty fines, but they can also negatively impact your auto insurance rates. But which traffic tickets affect insurance? Are all tickets treated equally? In this comprehensive guide, we’ll explore the most common traffic violations and their impact on your auto insurance premiums.

What Traffic Tickets Affect Insurance?

When it comes to traffic tickets, not all traffic violations are treated equally. Some violations may have a minimal impact on your insurance rates, while others can make your premiums skyrocket. Here are some of the most common traffic violations that can impact your auto insurance rates:

Speeding Tickets

Speeding tickets are one of the most common traffic violations, and they can undoubtedly impact your auto insurance rates. The faster you were driving, the more you can expect your rates to increase. On average, a single speeding ticket can raise your insurance rates by up to 20%. However, the exact increase will depend on how much you were over the speed limit and how often you’ve received a ticket in the past.

Reckless Driving

Reckless driving is a severe traffic violation that can have a significant impact on your auto insurance rates. It’s considered a major violation and, in some states, can even lead to the suspension or revocation of your driver’s license. This type of violation can raise your rates by 50% or more.

Running a Red Light

Running a red light is another serious traffic violation that can impact your auto insurance rates. It’s considered a major violation, and the consequences can be severe if an accident occurs as a result of running the light. On average, running a red light can increase your auto insurance rates by up to 30%.

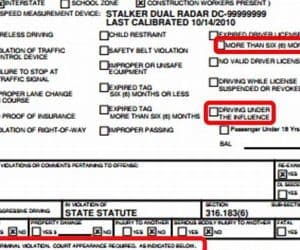

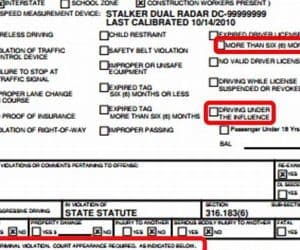

Driving Under the Influence (DUI)

Driving under the influence is a severe violation that can result in significant consequences, including hefty fines, license suspension, and even jail time. It’s also a major violation that can raise your auto insurance rates by up to 200%, depending on the state. Repeat offenses can cause even more significant increases in premiums.

Driving Without Insurance

Driving without insurance is not only illegal in most states, but it can also significantly impact your auto insurance rates. If you’re caught driving without insurance, you can expect your premiums to be raised by up to 50%. In addition, you may be required to file an SR-22, which can be costly.

At-Fault Accidents

If you’re at fault for an accident, you can expect your auto insurance rates to go up. Even if the accident was relatively minor, your rates can increase by up to 40%. The more severe the accident, the higher the increase. If you have multiple at-fault accidents on your record, your rates can increase by up to 75%.

Driving with a Suspended License

If your license has been suspended or revoked and you’re caught driving, it’s a major violation that can lead to increased insurance premiums. On average, driving with a suspended license can increase your auto insurance rates by up to 50%. In addition, if you’re caught driving with a suspended license, you may face further legal consequences, including fines and jail time.

FAQs

Q: How long do traffic violations affect insurance rates?

A: Traffic violations can typically impact your auto insurance rates for three to five years, depending on the severity of the violation and your insurance provider’s policies.

Q: Can traffic violations be removed from your driving record?

A: In some cases, traffic violations can be removed from your driving record. However, the process can be complicated and varies by state. It’s best to speak with your local DMV or an attorney to explore your options for removing violations from your record.

Q: Will my insurance rates go up after a first-time traffic violation?

A: It depends on the type of violation and your insurance provider’s policies. Some providers offer forgiveness for first-time violations, while others may increase your rates immediately. It’s essential to check with your provider to understand their specific policies.

Q: Can my auto insurance provider drop me for too many traffic violations?

A: It’s possible for auto insurance providers to drop policyholders for excessive violations. However, this varies by state and provider. If you’re worried about being dropped, it’s best to speak with your provider and try to make a plan to improve your driving habits.

Q: Will traffic violations always be reflected in my auto insurance rates?

A: It depends on the insurance provider and the type of violation. Some minor violations may not impact your rates, while others can lead to significant increases. It’s essential to check with your provider to understand their policies regarding specific traffic violations.

Q: Can I negotiate my auto insurance rates after receiving a traffic violation?

A: It’s possible to negotiate with your auto insurance provider regarding your rates after a traffic violation. However, it’s important to be proactive and honest with your provider about the violation and your plans to improve your driving habits.

Q: Are there any discounts available for drivers with traffic violations on their record?

A: It depends on the insurance provider and the type of violation. Some providers offer safe driving discounts for drivers with a history of violations who take defensive driving courses or have a history of safe driving. It’s essential to check with your provider to understand their specific policies regarding traffic violations.

Conclusion

If you’re a driver, it’s essential to understand which traffic tickets can impact your auto insurance rates. Violations such as speeding, reckless driving, running a red light, DUIs, driving without insurance, at-fault accidents, and driving with a suspended license can all impact your premiums. It’s important to be proactive and improve your driving habits to avoid these violations and maintain affordable insurance rates. Remember to always drive safely and responsibly to protect yourself and others on the road.

Rekomendasi:

- Drive Insurance Agent: Everything You Need to Know About IntroductionAre you looking for reliable car insurance that offers excellent coverage at a reasonable price? Then look no further than drive insurance agents. Drive insurance agents provide car insurance policies…

- Car Insurance Companies in North Carolina:… Car insurance is a must-have for every car owner. It offers financial protection in the event of an accident, theft or other damage to your vehicle. In North Carolina, drivers…

- Everything You Need to Know About Insurance… IntroductionBeing a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto…

- Auto Insurance Quote Ohio: Everything You Need to Know Auto insurance is a necessary expense for drivers in Ohio and across the United States. Insurance provides financial protection in case of an accident, theft, or other unforeseen events. However,…

- tips for auto insurance ## Tips for Auto Insurance: What You Need to KnowAs a car owner, having auto insurance is a must. It not only protects you financially in case of an accident,…

- Car Insurance Q: Everything You Need to Know IntroductionCar insurance is an essential aspect of owning a vehicle. It is a legal requirement in most states, and it protects you financially in the event of an accident. However,…

- Cheapest Auto Insurance Near Me Are you looking for affordable auto insurance coverage near your location? In today's world, having auto insurance is not merely an option but a legal requirement. The right auto insurance…

- Auto Insurance Orlando: Everything You Need to Know Are you searching for the best auto insurance in Orlando? Look no further! In this ultimate guide, we will cover everything you need to know about auto insurance in Orlando.…

- Car Insurance Binghamton NY: Protecting Your Vehicle… IntroductionCar insurance is a necessity for all motorists, and Binghamton, NY is no exception. While some drivers may feel that car insurance is an expense that they can avoid, the…

- Auto Insurance California Low Cost: How to Save… IntroductionWhen it comes to car insurance in California, there's no question that rates can be quite expensive. However, finding affordable auto insurance California low cost is not impossible. This article…

- Auto Insurance Quotes Sacramento: The Ultimate Guide IntroductionAuto insurance is essential for all drivers, and finding the right coverage can be a daunting task. In Sacramento, California, there are many insurance companies to choose from, each offering…

- Auto Town Insurance Norcross GA: Your Guide to… IntroductionDriving a car is a privilege that comes with responsibilities, and one of the most important ones is to have auto insurance. Auto insurance provides financial protection against damages or…

- Unraveling the Mystery of Bedford Car Insurance –… Are you a resident of Bedford and in search of the right car insurance for your vehicle? If yes, look no further as we're here to help. Purchasing car insurance…

- Private Auto Insurance BC: Everything You Need to Know Are you looking for auto insurance in British Columbia? Private auto insurance BC is one of the options available to drivers. While the provincial government provides basic coverage, private auto…

- Cheap Car Insurance Gastonia NC - Your Ultimate Guide Are you tired of paying high car insurance premiums in Gastonia, NC? Do you want to find affordable coverage that won't break the bank? Look no further! In this comprehensive…

- Auto Insurance New York City: Protecting Yourself… Living in New York City, owning and driving a vehicle is a necessity for most people. Whether it's for commuting to work, running errands, or simply enjoying a weekend drive,…

- Auto Insurance Albuquerque New Mexico: Guide to… Auto insurance can be a confusing topic for many people. There are so many different types of coverage, deductibles, and rates to consider. In this comprehensive guide to auto insurance…

- Everything You Need to Know About Automobile… IntroductionAutomobile insurance providers are companies that offer car insurance policies to drivers. These policies are designed to protect drivers from the financial burden of having to pay for damages or…

- Online Auto Insurance Quotes Ohio: Everything You… IntroductionAre you a car owner in Ohio? If yes, then you must have auto insurance for your vehicle. It is mandatory in Ohio to have auto insurance to drive legally.…

- How Insurance and Penalty Points Affect Your Driving Life? IntroductionDriving without insurance or accumulating penalty points can be a nightmare for any driver. Insurance and penalty points are two factors that can significantly impact your driving life. Understanding how…

- Auto Insurance Richmond: Everything You Need to Know IntroductionAre you a car owner in Richmond, Virginia, looking for the best auto insurance coverage at an affordable rate? Look no further! In this comprehensive guide, we will take you…

- Discounts for Auto Insurance: Everything You Need to Know Getting the Best Discounts for Auto InsuranceAuto insurance can be expensive, but there are ways to save money on your premiums. One of the best ways is to take advantage…

- Young Driver Car Insurance Quote: The Ultimate Guide Being a young driver can be incredibly exciting, but it also comes with a responsibility to drive safely and legally. One of the most important things that you need to…

- Auto Insurance Santa Fe NM: Everything You Need to Know IntroductionAre you looking for comprehensive auto insurance coverage in Santa Fe, NM? Look no further. In this article, we've compiled everything you need to know about auto insurance in Santa…

- The Ultimate Guide to AES Auto Insurance IntroductionIf you are a car owner, you must have heard about auto insurance. Protecting your car from unforeseen circumstances is essential. AES Auto Insurance is one of the top auto…

- CT Auto Insurance Quote: Your Ultimate Guide to… IntroductionAs a car owner in Connecticut, it’s imperative to have auto insurance. Not only is it required by law, but it also protects you and your vehicle from accidents and…

- Tennessee Car Insurance Quotes - Comprehensive Guide IntroductionCar insurance is one of the most important things to consider when you own a car. It keeps you financially protected in case of an accident or theft. However, finding…

- Auto Insurance Southern Pines NC: Everything You… IntroductionIf you are a car owner, you understand the importance of having auto insurance. In the event of an accident, insurance can cover the cost of repair or replacement of…

- Classic Car Insurance for 17 Year Olds: Everything… Classic cars are a thing of beauty, capturing the essence of another time. So, it's no surprise that many young people dream of owning one. However, if you're a 17-year-old…

- Auto Insurance Alabaster Al: Everything You Need to Know IntroductionAuto insurance is an essential requirement for all drivers in the United States. It provides financial protection against any damage or injury caused by you or your vehicle. Most states…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru