Introduction

Intravenous immunoglobulin (IVIG) is a medication used to treat various medical conditions, including immunodeficiency disorders, autoimmune disorders, and inflammatory diseases. As a patient seeking IVIG treatment, understanding your insurance coverage can be confusing and overwhelming. In this article, we will explore IVIG insurance coverage and provide answers to frequently asked questions.

IVIG Insurance Coverage

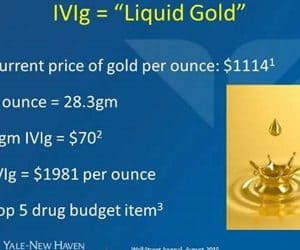

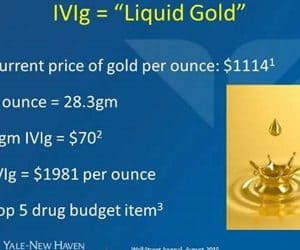

IVIG is a high-cost medication that requires prior authorization from insurance companies. Insurance coverage for IVIG varies depending on the medical condition, the type of health insurance plan, and the insurance company. However, most insurance companies cover IVIG under certain conditions.

What Conditions are Covered by IVIG Insurance?

Insurance companies cover IVIG for several medical conditions, including:

- Primary immunodeficiency disorders

- Secondary immunodeficiency disorders

- Autoimmune disorders

- Idiopathic thrombocytopenic purpura (ITP)

- Kawasaki disease

- Multifocal motor neuropathy (MMN)

What Type of Insurance Plans Cover IVIG?

Most insurance plans cover IVIG, including:

- Private health insurance plans

- Employer-sponsored health insurance plans

- Medicare

- Medicaid

- TRICARE

What Determines IVIG Coverage?

IVIG coverage is determined by several factors, including:

- The medical condition being treated

- The dosage and frequency of IVIG treatment

- The insurance company’s prior authorization requirements

- The patient’s medical history

What is Prior Authorization?

Prior authorization is a process in which insurance companies review the medical necessity and cost-effectiveness of a medication before approving coverage. Insurance companies require prior authorization for IVIG to ensure that the medication is the most appropriate and cost-effective treatment for the medical condition being treated.

What Does IVIG Insurance Coverage Include?

IVIG insurance coverage includes:

- The cost of the medication

- The cost of administration

- Other expenses associated with IVIG treatment

What Additional Costs Should I Expect?

While insurance companies cover the cost of IVIG, patients may still be responsible for certain costs, including:

- Co-payments

- Deductibles

- Out-of-pocket expenses

Will Insurance Cover All IVIG Treatments?

Insurance companies may not cover all IVIG treatments, particularly if they exceed the authorized dosage or frequency. Patients may be required to pay out-of-pocket for additional treatments.

FAQs

1. How Often Can I Receive IVIG Treatment?

The frequency of IVIG treatment varies depending on the medical condition being treated. Insurance companies may authorize treatment every 2 to 4 weeks.

2. What Happens if Insurance Doesn’t Cover IVIG Treatment?

If insurance doesn’t cover IVIG treatment, patients may be responsible for the entire cost. However, patients may be able to apply for financial assistance or patient assistance programs to help cover the cost.

3. What if I Exceed the Authorized Dosage or Frequency of IVIG Treatment?

If you exceed the authorized dosage or frequency of IVIG treatment, insurance companies may not cover the cost of additional treatments. Patients may be required to pay out-of-pocket for additional treatments.

4. Can I Change Insurance Companies to Get Better IVIG Coverage?

Patients may change insurance companies to get better IVIG coverage. However, patients should carefully review the insurance company’s policy on IVIG coverage before switching.

5. Should I Appeal a Denied IVIG Claim?

Patients should appeal a denied IVIG claim if they believe the claim was unfairly denied. Patients should work with their healthcare provider to provide additional information supporting the medical necessity of IVIG treatment.

6. How Long Does the Prior Authorization Process Take?

The prior authorization process can take several days to several weeks, depending on the insurance company’s requirements and the complexity of the medical condition being treated.

7. Will IVIG Insurance Coverage Change in the Future?

IVIG insurance coverage may change in the future as insurance companies review the cost-effectiveness of IVIG treatment. Patients should review their insurance plan carefully and be aware of any changes in coverage.

Conclusion

IVIG insurance coverage can be complicated, but patients have options for getting the treatment they need. By understanding IVIG insurance coverage, patients can make informed decisions and reduce the financial burden of treatment. If you have questions about IVIG insurance coverage, contact your insurance company or healthcare provider for more information.

Disclaimer: This article is for informational purposes only and does not constitute medical or legal advice. Please consult with your healthcare provider and insurance company for specific IVIG coverage information.

Rekomendasi:

- Triple Insurance Auto: Everything You Need to Know Getting insurance for your car is important to protect you financially in case of an accident, theft, or any other unfortunate event. Triple insurance auto is a comprehensive type of…

- Whitehead Insurance Yakima Hours - Protecting Your Assets About Whitehead Insurance Yakima HoursWhitehead Insurance Yakima Hours is an insurance agency that provides insurance services, financial planning, and investment management services to its clients. The company has been in…

- Everything You Need to Know About Car Insurance for… Car Insurance for Leased Cars: An OverviewCar insurance for leased cars is an important investment that every lessee needs to consider. When you lease a car, you don’t own it…

- Unraveling the Mystery of Bedford Car Insurance –… Are you a resident of Bedford and in search of the right car insurance for your vehicle? If yes, look no further as we're here to help. Purchasing car insurance…

- Geo Care Insurance - The Ultimate Guide Insurance is an important aspect of life and has become a necessity to safeguard our assets and future. There are various types of insurance policies available in the market, and…

- Switching Auto Insurance After Accident: The Ultimate Guide Introduction Switching auto insurance after an accident can be a daunting task for many people. You might be worried about the cost, coverage, or reputation of the new insurance company.…

- Car Insurance in St George Utah: A Comprehensive… IntroductionAre you a car owner in St George Utah? If yes, then you must know that driving without car insurance in St George Utah is illegal. Not only is it…

- Everything You Need to Know About Insurance Company… When it comes to insurance, there are a lot of options out there. However, not all insurance companies are created equal. In Houston, Texas, there are many insurance providers to…

- What is Open Car Insurance? A Comprehensive Guide IntroductionWhen it comes to purchasing car insurance, it's essential to make the right decision based on your needs, budget, and the level of coverage you require. One such option that…

- Cheap Car Insurance in Knoxville TN: How to Find the… IntroductionAre you a driver in Knoxville, Tennessee, who is looking for an affordable car insurance policy? You have come to the right place! In this article, we will explore the…

- Who is the Best Car Insurance Company for Young Drivers? Introduction:As a young driver, owning a car is a dream come true. However, getting it insured is another story. Finding the best car insurance company as a young driver is…

- Cheap Car Insurance Gastonia NC - Your Ultimate Guide Are you tired of paying high car insurance premiums in Gastonia, NC? Do you want to find affordable coverage that won't break the bank? Look no further! In this comprehensive…

- Cost U Less Insurance Sonora CA IntroductionAre you looking for affordable car insurance in Sonora, California? Look no further than Cost U Less Insurance Sonora CA. With their wide range of coverage options and excellent customer…

- Car Insurance NY vs NJ: Understanding the… Car insurance is one of the most significant expenses that comes with owning a car. However, the costs of car insurance vary significantly depending on a variety of factors like…

- Tennessee Car Insurance Quotes - Comprehensive Guide IntroductionCar insurance is one of the most important things to consider when you own a car. It keeps you financially protected in case of an accident or theft. However, finding…

- Auto Insurance for People Over 50: Everything You… IntroductionIf you are over 50 and looking for auto insurance, you might be wondering how to navigate this complex process. You may have heard that older drivers pay more for…

- Alaska USA Car Insurance: Protect Your Ride in the… The Importance of Car Insurance in Alaska USALiving in Alaska USA can be an exciting and thrilling experience, especially for those who love exploring nature and enjoy outdoor activities. However,…

- The Ultimate Guide to AES Auto Insurance IntroductionIf you are a car owner, you must have heard about auto insurance. Protecting your car from unforeseen circumstances is essential. AES Auto Insurance is one of the top auto…

- Check Car Insurance Coverage: Understand Your… Have you ever found yourself in a position where you were unsure if your car insurance would cover a certain event or situation? Car insurance is an essential investment for…

- Auto Insurance New York City: Protecting Yourself… Living in New York City, owning and driving a vehicle is a necessity for most people. Whether it's for commuting to work, running errands, or simply enjoying a weekend drive,…

- Car Insurance Binghamton NY: Protecting Your Vehicle… IntroductionCar insurance is a necessity for all motorists, and Binghamton, NY is no exception. While some drivers may feel that car insurance is an expense that they can avoid, the…

- Car Insurance OK: All You Need to Know Car insurance is a vital aspect of car ownership. It provides you with financial protection in case of accidents, theft, or damage to your vehicle. In Oklahoma, car insurance is…

- Everything You Need to Know About US Agency Car… IntroductionIf you live in Mobile, Alabama, and own a car, you know that car insurance is a must. It's a legal requirement to have car insurance to protect yourself and…

- Auto Insurance Quote Ohio: Everything You Need to Know Auto insurance is a necessary expense for drivers in Ohio and across the United States. Insurance provides financial protection in case of an accident, theft, or other unforeseen events. However,…

- Auto Insurance Santa Fe NM: Everything You Need to Know IntroductionAre you looking for comprehensive auto insurance coverage in Santa Fe, NM? Look no further. In this article, we've compiled everything you need to know about auto insurance in Santa…

- Auto Insurance Quote Minnesota: Everything You Need to Know IntroductionWhen it comes to purchasing car insurance, it is crucial to make an informed decision based on your specific needs and budget. With so many insurance companies and policies available,…

- Different Car Insurance Quotes: Everything You Need to Know Buying car insurance can be overwhelming and confusing. With so many providers, coverage options, and prices, it's difficult to know where to start. Before making any decisions, it's essential to…

- The Ultimate Guide to Salem Auto Insurance Salem Auto Insurance: Protecting Your Vehicle and Your WalletCar accidents are an unfortunate reality of life, and when they happen, they can be expensive. Repairing or replacing a damaged vehicle…

- Everything You Need to Know About Insurance… IntroductionBeing a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto…

- Crapo Insurance Terre Haute Indiana: Protecting You… Are you looking for a reliable insurance provider in Terre Haute, Indiana? Look no further than Crapo Insurance. With over 50 years of experience in the industry, we offer a…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru