The field of finance is always changing, and sustainable investing has emerged as a pivotal force in reshaping investment strategies.

As stewards of the global ecosystem, investors are increasingly turning their attention to Environmental, Social, and Governance (ESG) factors to make informed decisions that go beyond mere financial gains. In this comprehensive guide, We get into the details of sustainable trading and look at the ESG trends that are moving the financial markets.

Understanding ESG: A Holistic Approach

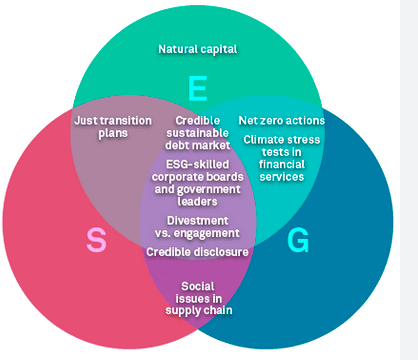

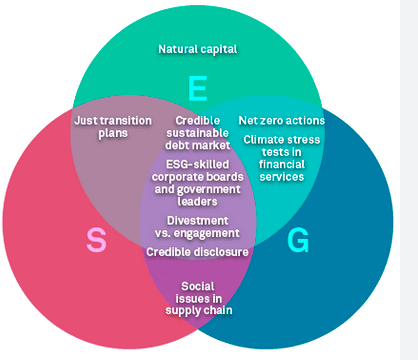

Environmental Factors

The ‘E’ in ESG encapsulates a broad spectrum of environmental considerations. From carbon emissions and resource conservation to renewable energy initiatives, investors scrutinize how companies integrate sustainability into their operations.

Forward-thinking organizations are not just meeting regulatory standards but are exceeding them, contributing to a healthier planet and, consequently, robust long-term financial performance.

Social Responsibility

Moving on to the ‘S’ in ESG, social responsibility is no longer a buzzword but a critical parameter in investment decision-making. Companies are assessed on their commitment to diversity and inclusion, employee welfare, and community engagement.

Social well-being influences investments in enterprises; however, they are ethical and adaptive to social issues.

Governance Excellence

The ‘G’ in ESG highlights the need for effective governance structures within firms. What investors are looking for today is transparency and ethics in leadership that bears the hallmarks of corporate responsibility in entities today. The strong governance structures protect against reputational risks and ensure sustained investment viability over the long term.

Emerging ESG Trends

Technology Integration

Technological integration is a growing trend in sustainable investing. Technology increasingly helps assess and monitor ESG factors, such as enhanced transparency in the supply chain with blockchain or AI-driven data analytics. Investors can benefit from these developments by having access to more significant insights into companies’ sustainability practices.

In an age of technological transformation, investors looking for options beyond established markets may benefit from the value Justmarkets has to offer as a platform that transcends sustainable investing. With the Forex trading aspect in mind, Justmarkets is an innovative channel that allows investors to venture into a fast-paced global currency market.

Social Impact Bonds

SIBs are becoming a powerful financial instrument in the field of ESG, enabling project financing for quantifiable social programs. This dual nature of reward in financial profits and positive societal impact influences investors.

Unlike other approaches, SIBs link financial objectives to social responsibility, providing a means for education and community development, among many other projects.

Biodiversity Investments

While environmental focus often centers on emissions and resource conservation, an evolving trend spotlights biodiversity conservation. Investors recognize the value of supporting companies engaged in preserving ecosystems, promoting sustainable agriculture, and combating deforestation. This holistic approach contributes to a resilient stance in sustainable investing.

Water Stewardship

Global water scarcity prompts investors to support companies actively involved in water stewardship. Beyond efficient water usage, this trend involves participation in community-based conservation initiatives. Investing in ethical water management aligns with broader sustainable goals and tackles a critical environmental challenge.

Sustainable Supply Chains

In line with the call for responsible business conduct, sustainable supply chain financing gains traction. Investors direct funds to companies meeting ESG criteria not just in operations but across their supply chains. The strategy encourages a socially responsible global economy by promoting ethical sourcing, fair labor, and environmental stewardship.

Green Real Estate

In real estate, the rise of sustainable and green buildings is evident. Investors prioritize eco-friendly construction projects that adhere to green standards. Beyond reducing carbon footprints, green real estate investments contribute to energy efficiency, water conservation, and overall environmental sustainability.

Sustainable Investing in Action

Forward-thinking investment firms are incorporating ESG considerations into their decision-making processes. By aligning portfolios with sustainable values, investors are not only making a positive impact on the world but also potentially mitigating risks associated with environmental and social controversies.

Contrary to outdated notions that sustainable investing compromises financial returns, numerous studies indicate that ESG-driven portfolios often outperform their traditional counterparts. As companies prioritize ethical practices and sustainable business models, they are better positioned for resilience and success in an ever-changing marketplace.

Navigating ESG Challenges

While the need for standardized, transparent reporting is a challenge in the field, Investors need reliable and comparable information in order to make informed decisions. Regarding ESG considerations’ credibility, industry efforts to create uniform reporting standards are indispensable.

Although the movement for sustainable investment is irreversible, some dissidents challenge the viability and influence of ESG implications on financial performance.

Campaigns to refute misunderstandings and highlight the advantages of incorporating ESG into investment strategies must prioritize education and awareness.

Conclusion

The financial environment is being transformed by sustainable investing. Matching investing to moral values becomes essential as ESG considerations grow more important. Businesses that adopt sustainability improve their long-term resilience and financial success. This calculated strategic move will yield real benefits, not just a passing fad.

Going forward, stricter regulations and more advanced technology won’t be the only factors shaping the future of sustainable investment. It’s an investment in a future where ethical financial decisions protect investors and promote a sustainable, fair economy on a global scale.

Rekomendasi:

- Auto Insurance York SC: Protecting Your Vehicle and… IntroductionAuto insurance is a necessity for anyone who wants to drive on public roads, and York, SC, is no exception. Whether you have just bought a new car or have…

- Understanding Insurance Claims for Car Accidents Insurance Claims for Car Accident: An IntroductionCar accidents are a common occurrence on roads and highways, and they can cause significant damage to property and people. When a car accident…

- Affordable Insurance SC: The Ultimate Guide to… Introduction: What is Affordable Insurance SC?Are you looking for affordable insurance in South Carolina? You've come to the right place. Affordable Insurance SC is a resource for South Carolina residents…

- What Color Cars Make Insurance Go Up: Debunking the Myths IntroductionWhen buying or leasing a car, many people consider the color of the vehicle as a factor to attract attention and show their personality. However, some drivers fear that choosing…

- Auto Insurance Quotes Denver Colorado - Everything… Auto insurance is a critical type of coverage that protects you and your vehicle in case of an accident. When you live in Denver, Colorado, you need to have the…

- Triple Insurance Auto: Everything You Need to Know Getting insurance for your car is important to protect you financially in case of an accident, theft, or any other unfortunate event. Triple insurance auto is a comprehensive type of…

- Auto Insurance in Panama City FL: Protect Your… IntroductionAuto insurance is a crucial aspect of owning a vehicle, no matter where you live. But in Panama City, Florida, a comprehensive auto insurance policy is even more important due…

- tips for auto insurance ## Tips for Auto Insurance: What You Need to KnowAs a car owner, having auto insurance is a must. It not only protects you financially in case of an accident,…

- Car Insurance Concord NH: Everything You Need to… The Basics of Car Insurance Concord NHIf you're a driver in Concord, New Hampshire, you know that having car insurance is a must. Not only is it required by law,…

- Tennessee Car Insurance Quotes - Comprehensive Guide IntroductionCar insurance is one of the most important things to consider when you own a car. It keeps you financially protected in case of an accident or theft. However, finding…

- Auto Insurance Quote Ohio: Everything You Need to Know Auto insurance is a necessary expense for drivers in Ohio and across the United States. Insurance provides financial protection in case of an accident, theft, or other unforeseen events. However,…

- Everything You Need to Know About Insurance… IntroductionBeing a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto…

- Car Bumper to Bumper Insurance: Protecting Your Investment Buying a new car can be a significant investment, and you want to make sure it's protected. That's where car bumper to bumper insurance comes in. Bumper to bumper insurance,…

- Car Insurance Newark DE- Your Guide to Finding the… IntroductionCar accidents are common occurrences that can happen to anyone at any time, regardless of how careful one is on the road. The damages caused by these accidents can be…

- Car Insurance OK: All You Need to Know Car insurance is a vital aspect of car ownership. It provides you with financial protection in case of accidents, theft, or damage to your vehicle. In Oklahoma, car insurance is…

- Auto Insurance Olathe KS: Everything You Need to Know A Brief Introduction to Auto Insurance Olathe KSAuto insurance is an essential policy for car owners. It provides financial protection in case of an accident, theft, or damage. Olathe KS,…

- Auto Insurance Orlando: Everything You Need to Know Are you searching for the best auto insurance in Orlando? Look no further! In this ultimate guide, we will cover everything you need to know about auto insurance in Orlando.…

- Asteroid Insurance: Protecting Yourself from a Cosmic Threat IntroductionAsteroids - chunks of rock and metal that orbit the Sun - are some of the most destructive forces in the universe. These space rocks can range in size from…

- Auto Insurance Santa Fe NM: Everything You Need to Know IntroductionAre you looking for comprehensive auto insurance coverage in Santa Fe, NM? Look no further. In this article, we've compiled everything you need to know about auto insurance in Santa…

- Auto Insurance Grand Rapids Michigan: Everything You… When it comes to driving in Grand Rapids, Michigan, auto insurance is a must-have. Not only is it required by law, but it also offers protection in the event of…

- Auto Insurance Madison MS: All You Need to Know… About Auto Insurance Madison MSAuto insurance is something every driver requires to operate a vehicle on the U.S. roads. Madison County in Mississippi is no exception, and automobile insurance is…

- Auto Insurance Quotes Rochester NY: Everything You… IntroductionAuto insurance is a crucial component of owning and driving a car. It protects you financially in case of an accident, theft, or other damages that may occur to your…

- Auto Town Insurance Norcross GA: Your Guide to… IntroductionDriving a car is a privilege that comes with responsibilities, and one of the most important ones is to have auto insurance. Auto insurance provides financial protection against damages or…

- Whitehead Insurance Yakima Hours - Protecting Your Assets About Whitehead Insurance Yakima HoursWhitehead Insurance Yakima Hours is an insurance agency that provides insurance services, financial planning, and investment management services to its clients. The company has been in…

- Sam Club Auto Insurance Quotes: Everything You Need to Know As a car owner, you understand the importance of having reliable auto insurance coverage that not only protects you but also meets your budget. Finding the right insurance policy can…

- Everything You Need to Know About US Agency Car… IntroductionIf you live in Mobile, Alabama, and own a car, you know that car insurance is a must. It's a legal requirement to have car insurance to protect yourself and…

- Auto Owners Insurance Customer Center: Your… IntroductionAuto Owners Insurance Customer Center is a place where policyholders can access all the information they need about their policies. From policy details to payment options, this customer center has…

- Cheap Car Insurance in Knoxville TN: How to Find the… IntroductionAre you a driver in Knoxville, Tennessee, who is looking for an affordable car insurance policy? You have come to the right place! In this article, we will explore the…

- CT Auto Insurance Quote: Your Ultimate Guide to… IntroductionAs a car owner in Connecticut, it’s imperative to have auto insurance. Not only is it required by law, but it also protects you and your vehicle from accidents and…

- Mesa AZ Auto Insurance: Your Comprehensive Guide Introduction Are you a car owner in Mesa, Arizona? One of the most important decisions you will make as a car owner is choosing the right auto insurance policy. Auto…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru