Introduction

Purchasing car insurance is a must for every car owner in Minnesota. It not only protects you from financial loss in case of accidents but is also mandatory by law. However, finding the right auto insurance policy at an affordable rate can be challenging. With the plethora of insurance providers in the market, it is difficult to decide which one to go for. This article is here to help you understand everything about Minnesota auto insurance quotes so that you can make an informed decision while purchasing one.

What are Minnesota auto insurance quotes?

Minnesota auto insurance quotes refer to the estimated cost of insuring your vehicle in the state of Minnesota. The quote takes into account a variety of factors such as your driving history, age, gender, type of car, and coverage level. It provides you with an estimate of the cost of the policy, including the premium amount, deductible, and coverage limit.

Factors that Affect Minnesota Auto Insurance Quotes

Several factors influence the cost of auto insurance in Minnesota. Knowing these factors can help you get a better understanding of how insurance providers calculate your premium. Here are some of the most important factors that affect Minnesota auto insurance quotes:

Driving Record

Your driving record is one of the most crucial factors that affect your auto insurance quote. If you have a history of accidents or traffic violations, your premium will be higher. Insurance providers consider drivers with a clean driving record less risky, and thus, offer lower rates.

Age and Gender

Age and gender are two other significant factors that affect your auto insurance quote. Younger drivers and male drivers typically tend to pay higher premiums as they are statistically more likely to get into accidents than older, female drivers.

Type of Car

The type of car you drive can also affect your auto insurance quote. The more expensive and luxurious your car is, the higher your premium will be. Cars with a higher safety rating are less risky to insure and, therefore, tend to have lower insurance rates.

Coverage Level

The level of coverage you choose also affects your auto insurance quote. If you opt for higher coverage limits, your premium will be higher. Similarly, if you choose a lower deductible, your premium will be higher.

Credit Score

Your credit score can also affect your auto insurance quote. Insurance providers consider drivers with a good credit score to be less risky, and thus, offer lower rates.

Location

The place you live in can also affect your auto insurance quote. If you reside in an area with high crime rates or have a higher risk of natural disasters, your premium will be higher.

Mileage

The number of miles you drive annually can also affect your auto insurance quote. The more miles you drive, the higher your premium will be.

How to Get Minnesota Auto Insurance Quotes

There are several ways to get Minnesota auto insurance quotes. You can either contact an insurance agent or use an online insurance comparison tool. Most insurance providers have websites where you can get a quote by entering your information and coverage preferences.

Getting multiple quotes from different insurance providers is essential as it can help you compare rates and choose the best policy for your needs.

Types of Auto Insurance Coverage in Minnesota

In Minnesota, there are three main types of auto insurance coverage:

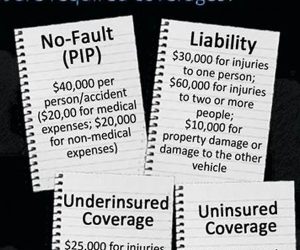

Liability Coverage

Liability insurance covers the cost of damage or injury caused to another person or their property in an accident you were responsible for. In Minnesota, the minimum liability coverage required by law is $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $10,000 for property damage.

Personal Injury Protection (PIP)

Personal injury protection covers medical expenses for you and your passengers in case of an accident, regardless of who is at fault. In Minnesota, PIP is mandatory, and the minimum coverage required by law is $40,000 per person per accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in case of an accident caused by a driver who doesn’t have enough insurance or doesn’t have insurance at all. It covers your medical expenses and property damage. In Minnesota, the minimum coverage required by law is $25,000 per person for bodily injury and $50,000 per accident.

Top Auto Insurance Providers in Minnesota

There are several auto insurance providers in Minnesota that offer affordable rates and comprehensive coverage. Here are the top auto insurance providers in Minnesota:

State Farm

State Farm is one of the largest auto insurance providers in the United States, and it offers competitive rates and excellent customer service. It offers various discounts, such as multi-policy and safe driving discounts.

Progressive

Progressive is another popular auto insurance provider in Minnesota. It offers customized insurance policies to cater to your individual needs and preferences. It also offers various discounts, such as good student and multi-car discounts.

Allstate

Allstate is known for its reliable and comprehensive auto insurance policies. It offers various coverage options, such as liability, collision, and comprehensive coverage. It also offers several discounts, such as the safe driving club and multi-policy discounts.

Geico

Geico is known for its affordable rates and user-friendly online platform. It offers various discounts, such as good driver and federal employee discounts. It also has a mobile app that allows you to manage your policy easily.

Frequently Asked Questions

Q1. Is auto insurance mandatory in Minnesota?

Yes, auto insurance is mandatory in Minnesota. The minimum liability coverage required by law is $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $10,000 for property damage.

Q2. What factors affect auto insurance rates in Minnesota?

Several factors affect auto insurance rates in Minnesota, such as driving record, age, gender, type of car, coverage level, credit score, location, and mileage.

Q3. How can I get multiple auto insurance quotes in Minnesota?

You can get multiple auto insurance quotes in Minnesota by contacting an insurance agent or using an online insurance comparison tool.

Q4. What types of auto insurance coverage are available in Minnesota?

In Minnesota, there are three main types of auto insurance coverage: liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Q5. What are some ways to lower auto insurance rates in Minnesota?

There are several ways to lower auto insurance rates in Minnesota, such as maintaining a clean driving record, choosing a car with a high safety rating, opting for a higher deductible, and taking advantage of discounts offered by insurance providers.

Q6. Can I drive without insurance in Minnesota?

No, it is illegal to drive without insurance in Minnesota. If you are caught driving without insurance, you may face hefty fines and license suspension.

Q7. What should I do if I get into an accident in Minnesota?

If you get into an accident in Minnesota, you should call the police, exchange insurance information with the other driver, and file a claim with your insurance provider as soon as possible.

Conclusion

Purchasing auto insurance can be overwhelming, but it is necessary to protect yourself and your vehicle. By understanding the factors that affect auto insurance rates in Minnesota, the types of coverage available, and the top auto insurance providers in the state, you can make an informed decision while purchasing auto insurance. Remember to compare quotes from multiple insurance providers before choosing the best policy for your needs.

**Note: The image used above is for illustrative purposes only.**

**Note: The image used above is for illustrative purposes only.**

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru