Introduction

Being a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto insurance. However, as a new driver, you may not know what to expect and how to get the best deal. This article aims to provide you with all the information you need to know about insurance estimates for new drivers, so you can make an informed decision.

Insurance Estimates for New Drivers: What You Need to Know

Auto insurance is a legal requirement for every driver in most states. Driving without insurance can lead to hefty fines and legal consequences. As a new driver, it’s essential to understand what insurance estimates are, how they are calculated, and what factors affect them.

What Are Insurance Estimates?

Insurance estimates, also known as insurance quotes, are the estimated costs of insurance coverage that drivers can expect to pay. These estimates are calculated based on various factors such as the driver’s age, gender, driving history, location, and the type of car being insured.

How Are Insurance Estimates Calculated?

Insurance estimates are calculated using complex algorithms that take various factors into account. These algorithms are used by insurance companies to determine the risk of insuring a driver. The higher the risk, the higher the insurance estimate will be.

What Factors Affect Insurance Estimates for New Drivers?

Several factors can affect insurance estimates for new drivers, including:

- Age: Younger drivers are usually considered high-risk and may face higher insurance estimates.

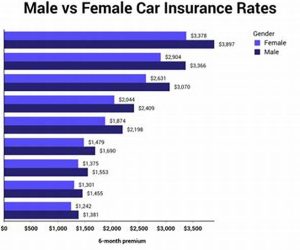

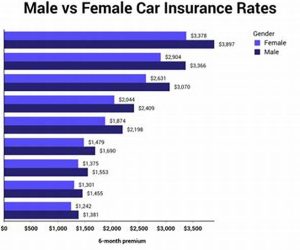

- Gender: In some states, male drivers may face higher insurance estimates than female drivers.

- Driving History: Your driving record plays a significant role in determining your insurance estimate. Drivers with a clean driving history are typically considered low-risk and may receive lower insurance estimates.

- Type of Car: The make and model of your car can also affect your insurance estimate. Sports cars and luxury vehicles are usually more expensive to insure.

- Location: Where you live can also impact your insurance estimate. Drivers in urban areas may face higher insurance estimates due to higher traffic and crime rates than those in rural areas.

- Coverage Level: The level of coverage you choose can also affect your insurance estimate. Higher coverage levels typically come with higher insurance estimates.

- Deductible: The deductible you choose can also impact your insurance estimate. A higher deductible usually means a lower insurance estimate.

How Can New Drivers Get the Best Insurance Estimates?

Getting the best insurance estimate as a new driver can be challenging, but there are ways to lower your insurance costs:

- Shop around: Compare quotes from different insurance companies to find the best deal for you.

- Take a defensive driving course: Some insurance companies offer discounts to drivers who complete a defensive driving course.

- Drive safely: Maintaining a clean driving record can help you get lower insurance estimates in the long run.

- Choose the right car: Choosing a car that is safe, reliable, and affordable to repair can help you get lower insurance estimates.

- Get good grades: Some insurance companies offer discounts to students who maintain good grades.

FAQs About Insurance Estimates for New Drivers

1. Do I Have to Get Auto Insurance as a New Driver?

Yes, auto insurance is a legal requirement for every driver in most states.

2. How Do Insurance Companies Calculate Insurance Estimates?

Insurance companies use complex algorithms that take various factors into account to calculate insurance estimates.

3. What Factors Affect Insurance Estimates for New Drivers?

Several factors can affect insurance estimates for new drivers, including age, gender, driving history, location, type of car, coverage level, and deductible.

4. How Can I Lower My Insurance Estimates as a New Driver?

You can lower your insurance estimates by shopping around for the best deal, taking a defensive driving course, driving safely, choosing the right car, and maintaining good grades.

5. What Happens If I Drive Without Insurance?

Driving without insurance can lead to hefty fines and legal consequences.

6. Can I Get Insurance Estimates for Different Levels of Coverage?

Yes, you can get insurance estimates for different levels of coverage from insurance companies.

7. Are There Any Discounts Available for New Drivers?

Some insurance companies offer discounts to new drivers who complete a driver’s education course or maintain good grades.

Conclusion

Getting auto insurance as a new driver can be overwhelming, but it’s essential to protect yourself and others on the road. Understanding insurance estimates, how they are calculated, and what factors affect them can help you make an informed decision when choosing an insurance policy. Remember to shop around for the best deal and take advantage of discounts that may be available to you. Drive safely and enjoy the freedom of the open road!

Note: This image is used for illustration purposes only.

Rekomendasi:

- Different Car Insurance Quotes: Everything You Need to Know Buying car insurance can be overwhelming and confusing. With so many providers, coverage options, and prices, it's difficult to know where to start. Before making any decisions, it's essential to…

- Auto Insurance in Gilroy, CA: Everything You Need to Know IntroductionAre you a resident of Gilroy, CA, in search of the best auto insurance coverage for your car? Do you want to save money on your premiums while ensuring maximum…

- What is Open Car Insurance? A Comprehensive Guide IntroductionWhen it comes to purchasing car insurance, it's essential to make the right decision based on your needs, budget, and the level of coverage you require. One such option that…

- Everything You Need to Know About Car Insurance in… IntroductionCar insurance is a necessary expense for anyone who owns or operates a vehicle in Pocatello, Idaho. With so many options available, it can be difficult to know where to…

- Auto Insurance SR22 Quotes: Everything You Need to Know Are you in search of a reliable and affordable auto insurance policy that includes SR22 coverage? Look no further. In this comprehensive guide, we will cover everything you need to…

- Online Auto Insurance Quotes Ohio: Everything You… IntroductionAre you a car owner in Ohio? If yes, then you must have auto insurance for your vehicle. It is mandatory in Ohio to have auto insurance to drive legally.…

- Car Insurance in Fitchburg MA - A Complete Guide An Overview of Car Insurance in Fitchburg MACar insurance is a legal requirement for all drivers in Fitchburg, MA. It not only protects you financially in case of an accident…

- About How Much is Car Insurance per Month IntroductionIf you own a car, you already know that car insurance is an essential expense that can't be avoided. While car insurance helps protect you financially if you're involved in…

- Cheap Auto Insurance in Orlando Florida: Keep Your… IntroductionOrlando, Florida is a city known for its beautiful beaches, theme parks, and warm weather. It's also a city where owning a car is essential to get around. But with…

- Private Auto Insurance BC: Everything You Need to Know Are you looking for auto insurance in British Columbia? Private auto insurance BC is one of the options available to drivers. While the provincial government provides basic coverage, private auto…

- How to Get Cheap Texas Auto Insurance IntroductionAre you a driver in Texas looking for affordable auto insurance? If so, you're in luck. In this article, we'll discuss everything you need to know about finding cheap Texas…

- Everything You Need to Know About SC Auto Insurance Rates IntroductionIf you own a car in South Carolina, you are required by law to have auto insurance. Auto insurance rates vary depending on the type of coverage you need, your…

- Auto Town Insurance Norcross GA: Your Guide to… IntroductionDriving a car is a privilege that comes with responsibilities, and one of the most important ones is to have auto insurance. Auto insurance provides financial protection against damages or…

- Cost U Less Insurance Sonora CA IntroductionAre you looking for affordable car insurance in Sonora, California? Look no further than Cost U Less Insurance Sonora CA. With their wide range of coverage options and excellent customer…

- Discounts for Auto Insurance: Everything You Need to Know Getting the Best Discounts for Auto InsuranceAuto insurance can be expensive, but there are ways to save money on your premiums. One of the best ways is to take advantage…

- Auto Insurance for Foreign Drivers: What You Need to Know IntroductionAre you a foreign driver planning to drive in the United States? If so, you must obtain auto insurance coverage to protect yourself and others on the road. Auto insurance…

- Insurance Quotes Chicago: Your Ultimate Guide to… IntroductionAre you living in the Windy City and in need of insurance coverage? Chicago, being one of the largest cities in the United States, has a lot of insurance companies…

- Drivers Insurance for New Drivers: Everything You… IntroductionGetting behind the wheel and learning how to drive is an exciting time for many new drivers. However, it also means you need to consider purchasing car insurance, which can…

- Auto Insurance Southern Pines NC: Everything You… IntroductionIf you are a car owner, you understand the importance of having auto insurance. In the event of an accident, insurance can cover the cost of repair or replacement of…

- Cheapest Auto Insurance Illinois: A Complete Guide… IntroductionIf you are a resident of Illinois, chances are that you own a car or any other vehicle. Driving your own vehicle gives you the freedom to travel around the…

- The Ultimate Guide to AES Auto Insurance IntroductionIf you are a car owner, you must have heard about auto insurance. Protecting your car from unforeseen circumstances is essential. AES Auto Insurance is one of the top auto…

- Auto Insurance Madison MS: All You Need to Know… About Auto Insurance Madison MSAuto insurance is something every driver requires to operate a vehicle on the U.S. roads. Madison County in Mississippi is no exception, and automobile insurance is…

- New Jersey Auto Insurance Quotes: Everything You… IntroductionWhy is Auto Insurance Important?Auto insurance is a legal necessity in New Jersey, required by law for all drivers. Auto insurance protects you financially in case of an accident. It…

- Auto Insurance Quote Ohio: Everything You Need to Know Auto insurance is a necessary expense for drivers in Ohio and across the United States. Insurance provides financial protection in case of an accident, theft, or other unforeseen events. However,…

- Designated Driver Insurance: Everything You Need to Know IntroductionDriving under the influence is a serious offense that can have severe consequences. A DUI conviction can result in hefty fines, license suspension, and even jail time in some cases.…

- Unraveling the Mystery of Bedford Car Insurance –… Are you a resident of Bedford and in search of the right car insurance for your vehicle? If yes, look no further as we're here to help. Purchasing car insurance…

- Auto Insurance Alabaster Al: Everything You Need to Know IntroductionAuto insurance is an essential requirement for all drivers in the United States. It provides financial protection against any damage or injury caused by you or your vehicle. Most states…

- Car Insurance OK: All You Need to Know Car insurance is a vital aspect of car ownership. It provides you with financial protection in case of accidents, theft, or damage to your vehicle. In Oklahoma, car insurance is…

- Cheap Car Insurance in Kent WA: Your Ultimate Guide Car insurance is a necessary expense for all drivers. Whether you’re a new driver or have been driving for years, car insurance is a must. It’s not only a legal…

- Car Insurance Binghamton NY: Protecting Your Vehicle… IntroductionCar insurance is a necessity for all motorists, and Binghamton, NY is no exception. While some drivers may feel that car insurance is an expense that they can avoid, the…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru