The Importance of Auto Insurance with Best Rates

Auto insurance is a necessity for every driver on the road. It provides financial protection in case of accidents, thefts, and other unforeseen events. As a result, finding auto insurance with the best rates is crucial to ensure you are adequately protected while also saving money. With the plethora of insurance providers out there, it can be challenging to find the best rates. However, with a little research and patience, you can secure the right coverage at the right price.

What is Auto Insurance with Best Rates?

Auto insurance with the best rates refers to policies that offer the most coverage for the least amount of money. These rates vary depending on several factors, including your driving history, age, gender, and location. The amount of coverage you need also plays a role in determining your auto insurance rates. The better your driving record and credit score, the more likely you are to receive lower rates.

Factors Affecting Auto Insurance Rates

Driving Record

Your driving record is one of the most significant factors that affect your auto insurance rates. If you have a history of accidents, traffic violations, or DUIs, you are considered a high-risk driver and will likely pay higher insurance rates. Conversely, if you have a clean driving record, your rates will be lower.

Credit Score

Believe it or not, your credit score can also impact your auto insurance rates. Insurance providers use your credit score to evaluate your financial responsibility and assess the risk of insuring you. If you have a poor credit score, you may be charged higher rates.

Age and Gender

Younger drivers, especially teenage males, typically pay higher auto insurance rates than older and female drivers. This is because younger drivers are more likely to get into accidents. Gender also plays a role in determining auto insurance rates, with males traditionally paying more than females.

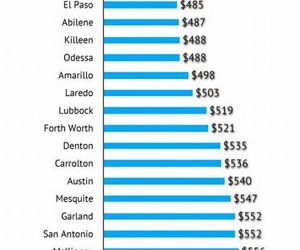

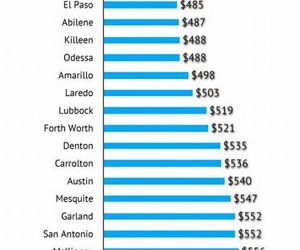

Location

Your location is also a significant factor in determining auto insurance rates. If you live in an area with high crime rates and a high number of accidents, you will likely pay higher rates. Conversely, if you live in a safe area with fewer accidents, your rates will be lower.

Type of Vehicle

The type of vehicle you drive can also impact your auto insurance rates. Sports cars and luxury vehicles typically cost more to insure than economy cars and mid-size sedans. This is because high-performance vehicles are more expensive to repair and replace.

Coverage Amount

The amount of coverage you choose also affects your auto insurance rates. The more coverage you have, the more you will pay in premiums. However, it is crucial to ensure you have enough coverage to protect yourself in case of an accident or theft.

Insurance Provider

Lastly, the insurance provider you choose also plays a role in determining your auto insurance rates. Each provider has its own pricing model, and rates can vary widely between providers. It is essential to research different insurance providers and compare quotes to find the best rates.

FAQs about Auto Insurance with Best Rates

1. How often should I shop around for auto insurance with the best rates?

You should shop around for auto insurance rates at least once a year. This allows you to compare quotes and find better rates. You may also want to shop around if your driving record or other circumstances change.

2. Can I get auto insurance with the best rates if I have a poor credit score?

Yes, it is possible to get auto insurance with the best rates even if you have a poor credit score. However, you may need to work with a provider that specializes in high-risk drivers.

3. How can I lower my auto insurance rates?

You can lower your auto insurance rates by maintaining a clean driving record, improving your credit score, choosing a safe vehicle, and taking advantage of discounts. You may also want to consider raising your deductibles to lower your premiums.

4. What discounts are available for auto insurance?

Some common discounts for auto insurance include safe driver discounts, multiple vehicle discounts, and bundling discounts. You may also be eligible for discounts if you are a student, a member of the military, or a member of a certain organization.

5. How much coverage do I need?

The amount of coverage you need depends on several factors, including your assets, income, and level of risk. It is essential to have enough coverage to protect yourself in case of an accident or theft.

6. How can I find the best auto insurance rates?

You can find the best auto insurance rates by researching different providers, comparing quotes, and taking advantage of discounts. It is also essential to read reviews and check the provider’s reputation before choosing a policy.

7. Can I negotiate auto insurance rates?

Yes, you can negotiate auto insurance rates. However, this is more common with independent agents than with larger insurance providers. You will need to have a good understanding of your coverage needs and the pricing in your area to negotiate effectively.

Conclusion

Auto insurance with the best rates is essential to ensure you are adequately protected while also saving money. By understanding the factors that affect your rates and shopping around for the best quotes, you can find the right coverage at the right price. Remember to compare quotes, take advantage of discounts, and read reviews before choosing a provider. With the right strategy, you can find the best auto insurance rates for your needs.

Disclaimer: This article is for informational purposes only and is not intended to provide legal or financial advice. It is essential to consult with a licensed professional before making any decisions regarding auto insurance.

Rekomendasi:

- Best Rates Insurance: The Ultimate Guide to Finding… When it comes to insurance, finding the best rates for your specific needs can be a daunting task. With so many different providers, policies, and coverage options available, it's easy…

- The Importance of The GeneralAuto Insurance:… The GeneralAuto InsuranceAuto insurance is a type of insurance that provides financial protection for drivers in the event of an accident. The GeneralAuto Insurance has become an essential requirement for…

- Auto Insurance in Gilroy, CA: Everything You Need to Know IntroductionAre you a resident of Gilroy, CA, in search of the best auto insurance coverage for your car? Do you want to save money on your premiums while ensuring maximum…

- Auto Insurance Southern Pines NC: Everything You… IntroductionIf you are a car owner, you understand the importance of having auto insurance. In the event of an accident, insurance can cover the cost of repair or replacement of…

- Cheap Car Insurance Gastonia NC - Your Ultimate Guide Are you tired of paying high car insurance premiums in Gastonia, NC? Do you want to find affordable coverage that won't break the bank? Look no further! In this comprehensive…

- Designated Driver Insurance: Everything You Need to Know IntroductionDriving under the influence is a serious offense that can have severe consequences. A DUI conviction can result in hefty fines, license suspension, and even jail time in some cases.…

- Auto Insurance Albuquerque New Mexico: Guide to… Auto insurance can be a confusing topic for many people. There are so many different types of coverage, deductibles, and rates to consider. In this comprehensive guide to auto insurance…

- Minnesota Auto Insurance Quotes: Everything You Need to Know IntroductionPurchasing car insurance is a must for every car owner in Minnesota. It not only protects you from financial loss in case of accidents but is also mandatory by law.…

- Everything You Need to Know About A AAable Auto Insurance The Benefits of A AAable Auto InsuranceAre you looking for auto insurance that is affordable, reliable, and designed to fit your needs? Look no further than A AAable Auto Insurance!…

- Auto Insurance Premium Increase: Everything You Need to Know IntroductionAuto insurance is essential for drivers in today's world. It protects you financially in the event of an accident, theft, or any other damage to your vehicle. However, are you…

- Mesa AZ Auto Insurance: Your Comprehensive Guide Introduction Are you a car owner in Mesa, Arizona? One of the most important decisions you will make as a car owner is choosing the right auto insurance policy. Auto…

- Car Insurance Companies in Cheyenne Wyoming IntroductionIf you are a car owner in Cheyenne, Wyoming, you must be aware of the fact that car insurance is mandatory in the state. Car insurance protects you and your…

- Affordable Insurance SC: The Ultimate Guide to… Introduction: What is Affordable Insurance SC?Are you looking for affordable insurance in South Carolina? You've come to the right place. Affordable Insurance SC is a resource for South Carolina residents…

- Auto Insurance for Foreign Drivers: What You Need to Know IntroductionAre you a foreign driver planning to drive in the United States? If so, you must obtain auto insurance coverage to protect yourself and others on the road. Auto insurance…

- Auto Insurance Grand Rapids Michigan: Everything You… When it comes to driving in Grand Rapids, Michigan, auto insurance is a must-have. Not only is it required by law, but it also offers protection in the event of…

- Car Insurance OK: All You Need to Know Car insurance is a vital aspect of car ownership. It provides you with financial protection in case of accidents, theft, or damage to your vehicle. In Oklahoma, car insurance is…

- Doherty Insurance Andover Mass: The Ultimate Guide Doherty Insurance Andover MassWhen it comes to insurance, you want to make sure that you are partnering with the best insurer to protect yourself from any unforeseen circumstances. Doherty Insurance…

- Auto Insurance Quotes Denver Colorado - Everything… Auto insurance is a critical type of coverage that protects you and your vehicle in case of an accident. When you live in Denver, Colorado, you need to have the…

- Auto Insurance Quotes Rochester NY: Everything You… IntroductionAuto insurance is a crucial component of owning and driving a car. It protects you financially in case of an accident, theft, or other damages that may occur to your…

- Richmond Auto Insurance: Protecting Your Vehicle and… Introduction: The Importance of Adequate Auto Insurance CoverageAs a car owner, you understand the importance of having auto insurance coverage to protect yourself and your vehicle. Whether you are driving…

- Everything You Need to Know About Insurance Company… When it comes to insurance, there are a lot of options out there. However, not all insurance companies are created equal. In Houston, Texas, there are many insurance providers to…

- How to Get Cheap Texas Auto Insurance IntroductionAre you a driver in Texas looking for affordable auto insurance? If so, you're in luck. In this article, we'll discuss everything you need to know about finding cheap Texas…

- Auto Insurance Quote Minnesota: Everything You Need to Know IntroductionWhen it comes to purchasing car insurance, it is crucial to make an informed decision based on your specific needs and budget. With so many insurance companies and policies available,…

- Cheapest Auto Insurance Illinois: A Complete Guide… IntroductionIf you are a resident of Illinois, chances are that you own a car or any other vehicle. Driving your own vehicle gives you the freedom to travel around the…

- Cheapest Auto Insurance in Indiana – The Ultimate Guide IntroductionAre you an Indiana resident looking for the cheapest auto insurance policy? Do you feel overwhelmed with the vast number of choices available in the market? Worry not, because in…

- CT Auto Insurance Quote: Your Ultimate Guide to… IntroductionAs a car owner in Connecticut, it’s imperative to have auto insurance. Not only is it required by law, but it also protects you and your vehicle from accidents and…

- Auto Insurance West Haven CT: Protecting Your… IntroductionAuto insurance is a necessary expense that every vehicle owner must face. Whether you're driving a brand-new car or an old clunker, having insurance coverage can protect you financially in…

- Everything You Need to Know About Car Insurance in… IntroductionCar insurance is a necessary expense for anyone who owns or operates a vehicle in Pocatello, Idaho. With so many options available, it can be difficult to know where to…

- Auto Insurance New York City: Protecting Yourself… Living in New York City, owning and driving a vehicle is a necessity for most people. Whether it's for commuting to work, running errands, or simply enjoying a weekend drive,…

- Car Insurance in Akron Ohio: Protecting Your Life's… IntroductionCar insurance is a necessary evil when it comes to owning a vehicle. It's something most people don't want to think about, but it's critical in the event of an…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru