Introduction

Intravenous immunoglobulin (IVIG) is a medication used to treat various medical conditions, including immunodeficiency disorders, autoimmune disorders, and inflammatory diseases. As a patient seeking IVIG treatment, understanding your insurance coverage can be confusing and overwhelming. In this article, we will explore IVIG insurance coverage and provide answers to frequently asked questions.

IVIG Insurance Coverage

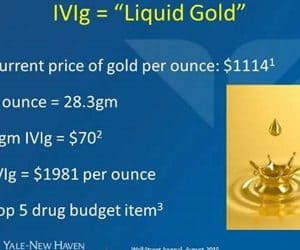

IVIG is a high-cost medication that requires prior authorization from insurance companies. Insurance coverage for IVIG varies depending on the medical condition, the type of health insurance plan, and the insurance company. However, most insurance companies cover IVIG under certain conditions.

What Conditions are Covered by IVIG Insurance?

Insurance companies cover IVIG for several medical conditions, including:

- Primary immunodeficiency disorders

- Secondary immunodeficiency disorders

- Autoimmune disorders

- Idiopathic thrombocytopenic purpura (ITP)

- Kawasaki disease

- Multifocal motor neuropathy (MMN)

What Type of Insurance Plans Cover IVIG?

Most insurance plans cover IVIG, including:

- Private health insurance plans

- Employer-sponsored health insurance plans

- Medicare

- Medicaid

- TRICARE

What Determines IVIG Coverage?

IVIG coverage is determined by several factors, including:

- The medical condition being treated

- The dosage and frequency of IVIG treatment

- The insurance company’s prior authorization requirements

- The patient’s medical history

What is Prior Authorization?

Prior authorization is a process in which insurance companies review the medical necessity and cost-effectiveness of a medication before approving coverage. Insurance companies require prior authorization for IVIG to ensure that the medication is the most appropriate and cost-effective treatment for the medical condition being treated.

What Does IVIG Insurance Coverage Include?

IVIG insurance coverage includes:

- The cost of the medication

- The cost of administration

- Other expenses associated with IVIG treatment

What Additional Costs Should I Expect?

While insurance companies cover the cost of IVIG, patients may still be responsible for certain costs, including:

- Co-payments

- Deductibles

- Out-of-pocket expenses

Will Insurance Cover All IVIG Treatments?

Insurance companies may not cover all IVIG treatments, particularly if they exceed the authorized dosage or frequency. Patients may be required to pay out-of-pocket for additional treatments.

FAQs

1. How Often Can I Receive IVIG Treatment?

The frequency of IVIG treatment varies depending on the medical condition being treated. Insurance companies may authorize treatment every 2 to 4 weeks.

2. What Happens if Insurance Doesn’t Cover IVIG Treatment?

If insurance doesn’t cover IVIG treatment, patients may be responsible for the entire cost. However, patients may be able to apply for financial assistance or patient assistance programs to help cover the cost.

3. What if I Exceed the Authorized Dosage or Frequency of IVIG Treatment?

If you exceed the authorized dosage or frequency of IVIG treatment, insurance companies may not cover the cost of additional treatments. Patients may be required to pay out-of-pocket for additional treatments.

4. Can I Change Insurance Companies to Get Better IVIG Coverage?

Patients may change insurance companies to get better IVIG coverage. However, patients should carefully review the insurance company’s policy on IVIG coverage before switching.

5. Should I Appeal a Denied IVIG Claim?

Patients should appeal a denied IVIG claim if they believe the claim was unfairly denied. Patients should work with their healthcare provider to provide additional information supporting the medical necessity of IVIG treatment.

6. How Long Does the Prior Authorization Process Take?

The prior authorization process can take several days to several weeks, depending on the insurance company’s requirements and the complexity of the medical condition being treated.

7. Will IVIG Insurance Coverage Change in the Future?

IVIG insurance coverage may change in the future as insurance companies review the cost-effectiveness of IVIG treatment. Patients should review their insurance plan carefully and be aware of any changes in coverage.

Conclusion

IVIG insurance coverage can be complicated, but patients have options for getting the treatment they need. By understanding IVIG insurance coverage, patients can make informed decisions and reduce the financial burden of treatment. If you have questions about IVIG insurance coverage, contact your insurance company or healthcare provider for more information.

Disclaimer: This article is for informational purposes only and does not constitute medical or legal advice. Please consult with your healthcare provider and insurance company for specific IVIG coverage information.

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru