Introduction

Being a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto insurance. However, as a new driver, you may not know what to expect and how to get the best deal. This article aims to provide you with all the information you need to know about insurance estimates for new drivers, so you can make an informed decision.

Insurance Estimates for New Drivers: What You Need to Know

Auto insurance is a legal requirement for every driver in most states. Driving without insurance can lead to hefty fines and legal consequences. As a new driver, it’s essential to understand what insurance estimates are, how they are calculated, and what factors affect them.

What Are Insurance Estimates?

Insurance estimates, also known as insurance quotes, are the estimated costs of insurance coverage that drivers can expect to pay. These estimates are calculated based on various factors such as the driver’s age, gender, driving history, location, and the type of car being insured.

How Are Insurance Estimates Calculated?

Insurance estimates are calculated using complex algorithms that take various factors into account. These algorithms are used by insurance companies to determine the risk of insuring a driver. The higher the risk, the higher the insurance estimate will be.

What Factors Affect Insurance Estimates for New Drivers?

Several factors can affect insurance estimates for new drivers, including:

- Age: Younger drivers are usually considered high-risk and may face higher insurance estimates.

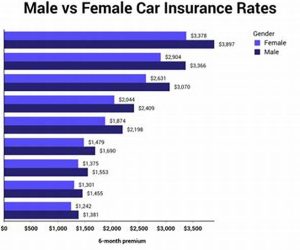

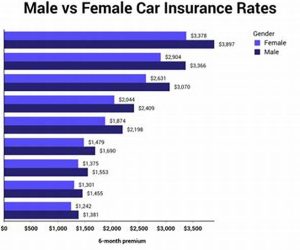

- Gender: In some states, male drivers may face higher insurance estimates than female drivers.

- Driving History: Your driving record plays a significant role in determining your insurance estimate. Drivers with a clean driving history are typically considered low-risk and may receive lower insurance estimates.

- Type of Car: The make and model of your car can also affect your insurance estimate. Sports cars and luxury vehicles are usually more expensive to insure.

- Location: Where you live can also impact your insurance estimate. Drivers in urban areas may face higher insurance estimates due to higher traffic and crime rates than those in rural areas.

- Coverage Level: The level of coverage you choose can also affect your insurance estimate. Higher coverage levels typically come with higher insurance estimates.

- Deductible: The deductible you choose can also impact your insurance estimate. A higher deductible usually means a lower insurance estimate.

How Can New Drivers Get the Best Insurance Estimates?

Getting the best insurance estimate as a new driver can be challenging, but there are ways to lower your insurance costs:

- Shop around: Compare quotes from different insurance companies to find the best deal for you.

- Take a defensive driving course: Some insurance companies offer discounts to drivers who complete a defensive driving course.

- Drive safely: Maintaining a clean driving record can help you get lower insurance estimates in the long run.

- Choose the right car: Choosing a car that is safe, reliable, and affordable to repair can help you get lower insurance estimates.

- Get good grades: Some insurance companies offer discounts to students who maintain good grades.

FAQs About Insurance Estimates for New Drivers

1. Do I Have to Get Auto Insurance as a New Driver?

Yes, auto insurance is a legal requirement for every driver in most states.

2. How Do Insurance Companies Calculate Insurance Estimates?

Insurance companies use complex algorithms that take various factors into account to calculate insurance estimates.

3. What Factors Affect Insurance Estimates for New Drivers?

Several factors can affect insurance estimates for new drivers, including age, gender, driving history, location, type of car, coverage level, and deductible.

4. How Can I Lower My Insurance Estimates as a New Driver?

You can lower your insurance estimates by shopping around for the best deal, taking a defensive driving course, driving safely, choosing the right car, and maintaining good grades.

5. What Happens If I Drive Without Insurance?

Driving without insurance can lead to hefty fines and legal consequences.

6. Can I Get Insurance Estimates for Different Levels of Coverage?

Yes, you can get insurance estimates for different levels of coverage from insurance companies.

7. Are There Any Discounts Available for New Drivers?

Some insurance companies offer discounts to new drivers who complete a driver’s education course or maintain good grades.

Conclusion

Getting auto insurance as a new driver can be overwhelming, but it’s essential to protect yourself and others on the road. Understanding insurance estimates, how they are calculated, and what factors affect them can help you make an informed decision when choosing an insurance policy. Remember to shop around for the best deal and take advantage of discounts that may be available to you. Drive safely and enjoy the freedom of the open road!

Note: This image is used for illustration purposes only.

Rekomendasi:

- Auto Insurance with Best Rates The Importance of Auto Insurance with Best RatesAuto insurance is a necessity for every driver on the road. It provides financial protection in case of accidents, thefts, and other unforeseen…

- Cornerstone National Auto Insurance: Your Ultimate Guide IntroductionLooking for a reliable auto insurance company can be a daunting task. With so many options available, it can be difficult to determine which one is right for you. Fortunately,…

- Auto Insurance Quotes Sacramento: The Ultimate Guide IntroductionAuto insurance is essential for all drivers, and finding the right coverage can be a daunting task. In Sacramento, California, there are many insurance companies to choose from, each offering…

- Everything You Need to Know About Automobile… IntroductionAutomobile insurance providers are companies that offer car insurance policies to drivers. These policies are designed to protect drivers from the financial burden of having to pay for damages or…

- New Jersey Auto Insurance Quotes: Everything You… IntroductionWhy is Auto Insurance Important?Auto insurance is a legal necessity in New Jersey, required by law for all drivers. Auto insurance protects you financially in case of an accident. It…

- Auto Insurance Olathe KS: Everything You Need to Know A Brief Introduction to Auto Insurance Olathe KSAuto insurance is an essential policy for car owners. It provides financial protection in case of an accident, theft, or damage. Olathe KS,…

- Minnesota Auto Insurance Quotes: Everything You Need to Know IntroductionPurchasing car insurance is a must for every car owner in Minnesota. It not only protects you from financial loss in case of accidents but is also mandatory by law.…

- Unraveling the Mystery of Bedford Car Insurance –… Are you a resident of Bedford and in search of the right car insurance for your vehicle? If yes, look no further as we're here to help. Purchasing car insurance…

- Richmond Auto Insurance: Protecting Your Vehicle and… Introduction: The Importance of Adequate Auto Insurance CoverageAs a car owner, you understand the importance of having auto insurance coverage to protect yourself and your vehicle. Whether you are driving…

- Private Auto Insurance BC: Everything You Need to Know Are you looking for auto insurance in British Columbia? Private auto insurance BC is one of the options available to drivers. While the provincial government provides basic coverage, private auto…

- Everything You Need to Know About Auto Insurance… If you are a resident of Kentucky, you know how important it is to have auto insurance. Auto insurance not only protects you from financial loss in the case of…

- Auto Insurance for People Over 50: Everything You… IntroductionIf you are over 50 and looking for auto insurance, you might be wondering how to navigate this complex process. You may have heard that older drivers pay more for…

- Tennessee Car Insurance Quotes - Comprehensive Guide IntroductionCar insurance is one of the most important things to consider when you own a car. It keeps you financially protected in case of an accident or theft. However, finding…

- insurance agents ct Insurance Agents CT: Everything You Need to KnowIntroductionAre you searching for a reliable insurance agent in CT? Insurance can be a complicated subject, and finding the right coverage can be…

- Utah Minimum Auto Insurance Requirements IntroductionAuto insurance is an important aspect of owning a car, and Utah state law requires drivers to carry minimum auto insurance coverage. Understanding the minimum requirements for auto insurance coverage…

- Auto Insurance in Panama City FL: Protect Your… IntroductionAuto insurance is a crucial aspect of owning a vehicle, no matter where you live. But in Panama City, Florida, a comprehensive auto insurance policy is even more important due…

- Alaska USA Car Insurance: Protect Your Ride in the… The Importance of Car Insurance in Alaska USALiving in Alaska USA can be an exciting and thrilling experience, especially for those who love exploring nature and enjoy outdoor activities. However,…

- Auto Insurance in Gilroy, CA: Everything You Need to Know IntroductionAre you a resident of Gilroy, CA, in search of the best auto insurance coverage for your car? Do you want to save money on your premiums while ensuring maximum…

- Cheapest Auto Insurance Illinois: A Complete Guide… IntroductionIf you are a resident of Illinois, chances are that you own a car or any other vehicle. Driving your own vehicle gives you the freedom to travel around the…

- Insurance Quotes Chicago: Your Ultimate Guide to… IntroductionAre you living in the Windy City and in need of insurance coverage? Chicago, being one of the largest cities in the United States, has a lot of insurance companies…

- Drive Insurance Agent: Everything You Need to Know About IntroductionAre you looking for reliable car insurance that offers excellent coverage at a reasonable price? Then look no further than drive insurance agents. Drive insurance agents provide car insurance policies…

- Car Insurance Quotes Springfield MO: Everything You… IntroductionCar insurance is a crucial aspect of car ownership that protects you financially in the event of an accident. In Springfield, MO, the legal minimum requirement for car insurance is…

- Auto Insurance Southern Pines NC: Everything You… IntroductionIf you are a car owner, you understand the importance of having auto insurance. In the event of an accident, insurance can cover the cost of repair or replacement of…

- Auto Insurance Premium Increase: Everything You Need to Know IntroductionAuto insurance is essential for drivers in today's world. It protects you financially in the event of an accident, theft, or any other damage to your vehicle. However, are you…

- Auto Insurance Alabaster Al: Everything You Need to Know IntroductionAuto insurance is an essential requirement for all drivers in the United States. It provides financial protection against any damage or injury caused by you or your vehicle. Most states…

- A Good Car Insurance Company: Everything You Need to Know IntroductionAre you looking for the best car insurance company? You have come to the right place. Finding a good car insurance company can be overwhelming, especially with the plethora of…

- About How Much is Car Insurance per Month IntroductionIf you own a car, you already know that car insurance is an essential expense that can't be avoided. While car insurance helps protect you financially if you're involved in…

- Who is the Best Car Insurance Company for Young Drivers? Introduction:As a young driver, owning a car is a dream come true. However, getting it insured is another story. Finding the best car insurance company as a young driver is…

- The Ultimate Guide to Idaho Falls Car Insurance Idaho Falls Car InsuranceIdaho Falls car insurance is a type of insurance that protects drivers from the financial loss associated with accidents, theft, and other incidents involving their vehicles. It…

- Cost U Less Insurance Sonora CA IntroductionAre you looking for affordable car insurance in Sonora, California? Look no further than Cost U Less Insurance Sonora CA. With their wide range of coverage options and excellent customer…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru