If you’re a driver, you know that receiving a traffic ticket is never a good feeling. Not only do they come with hefty fines, but they can also negatively impact your auto insurance rates. But which traffic tickets affect insurance? Are all tickets treated equally? In this comprehensive guide, we’ll explore the most common traffic violations and their impact on your auto insurance premiums.

What Traffic Tickets Affect Insurance?

When it comes to traffic tickets, not all traffic violations are treated equally. Some violations may have a minimal impact on your insurance rates, while others can make your premiums skyrocket. Here are some of the most common traffic violations that can impact your auto insurance rates:

Speeding Tickets

Speeding tickets are one of the most common traffic violations, and they can undoubtedly impact your auto insurance rates. The faster you were driving, the more you can expect your rates to increase. On average, a single speeding ticket can raise your insurance rates by up to 20%. However, the exact increase will depend on how much you were over the speed limit and how often you’ve received a ticket in the past.

Reckless Driving

Reckless driving is a severe traffic violation that can have a significant impact on your auto insurance rates. It’s considered a major violation and, in some states, can even lead to the suspension or revocation of your driver’s license. This type of violation can raise your rates by 50% or more.

Running a Red Light

Running a red light is another serious traffic violation that can impact your auto insurance rates. It’s considered a major violation, and the consequences can be severe if an accident occurs as a result of running the light. On average, running a red light can increase your auto insurance rates by up to 30%.

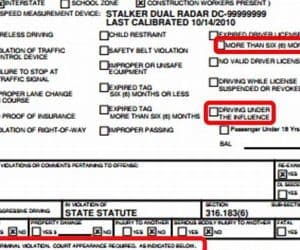

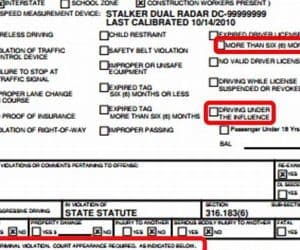

Driving Under the Influence (DUI)

Driving under the influence is a severe violation that can result in significant consequences, including hefty fines, license suspension, and even jail time. It’s also a major violation that can raise your auto insurance rates by up to 200%, depending on the state. Repeat offenses can cause even more significant increases in premiums.

Driving Without Insurance

Driving without insurance is not only illegal in most states, but it can also significantly impact your auto insurance rates. If you’re caught driving without insurance, you can expect your premiums to be raised by up to 50%. In addition, you may be required to file an SR-22, which can be costly.

At-Fault Accidents

If you’re at fault for an accident, you can expect your auto insurance rates to go up. Even if the accident was relatively minor, your rates can increase by up to 40%. The more severe the accident, the higher the increase. If you have multiple at-fault accidents on your record, your rates can increase by up to 75%.

Driving with a Suspended License

If your license has been suspended or revoked and you’re caught driving, it’s a major violation that can lead to increased insurance premiums. On average, driving with a suspended license can increase your auto insurance rates by up to 50%. In addition, if you’re caught driving with a suspended license, you may face further legal consequences, including fines and jail time.

FAQs

Q: How long do traffic violations affect insurance rates?

A: Traffic violations can typically impact your auto insurance rates for three to five years, depending on the severity of the violation and your insurance provider’s policies.

Q: Can traffic violations be removed from your driving record?

A: In some cases, traffic violations can be removed from your driving record. However, the process can be complicated and varies by state. It’s best to speak with your local DMV or an attorney to explore your options for removing violations from your record.

Q: Will my insurance rates go up after a first-time traffic violation?

A: It depends on the type of violation and your insurance provider’s policies. Some providers offer forgiveness for first-time violations, while others may increase your rates immediately. It’s essential to check with your provider to understand their specific policies.

Q: Can my auto insurance provider drop me for too many traffic violations?

A: It’s possible for auto insurance providers to drop policyholders for excessive violations. However, this varies by state and provider. If you’re worried about being dropped, it’s best to speak with your provider and try to make a plan to improve your driving habits.

Q: Will traffic violations always be reflected in my auto insurance rates?

A: It depends on the insurance provider and the type of violation. Some minor violations may not impact your rates, while others can lead to significant increases. It’s essential to check with your provider to understand their policies regarding specific traffic violations.

Q: Can I negotiate my auto insurance rates after receiving a traffic violation?

A: It’s possible to negotiate with your auto insurance provider regarding your rates after a traffic violation. However, it’s important to be proactive and honest with your provider about the violation and your plans to improve your driving habits.

Q: Are there any discounts available for drivers with traffic violations on their record?

A: It depends on the insurance provider and the type of violation. Some providers offer safe driving discounts for drivers with a history of violations who take defensive driving courses or have a history of safe driving. It’s essential to check with your provider to understand their specific policies regarding traffic violations.

Conclusion

If you’re a driver, it’s essential to understand which traffic tickets can impact your auto insurance rates. Violations such as speeding, reckless driving, running a red light, DUIs, driving without insurance, at-fault accidents, and driving with a suspended license can all impact your premiums. It’s important to be proactive and improve your driving habits to avoid these violations and maintain affordable insurance rates. Remember to always drive safely and responsibly to protect yourself and others on the road.

Rekomendasi:

- Car Insurance Q: Everything You Need to Know IntroductionCar insurance is an essential aspect of owning a vehicle. It is a legal requirement in most states, and it protects you financially in the event of an accident. However,…

- Everything You Need to Know About Insurance… IntroductionBeing a new driver is exciting, but it can also be daunting. One of the essential tasks you have to take care of when you start driving is getting auto…

- Auto Insurance Quote Minnesota: Everything You Need to Know IntroductionWhen it comes to purchasing car insurance, it is crucial to make an informed decision based on your specific needs and budget. With so many insurance companies and policies available,…

- Tennessee Car Insurance Quotes - Comprehensive Guide IntroductionCar insurance is one of the most important things to consider when you own a car. It keeps you financially protected in case of an accident or theft. However, finding…

- Auto Insurance for Foreign Drivers: What You Need to Know IntroductionAre you a foreign driver planning to drive in the United States? If so, you must obtain auto insurance coverage to protect yourself and others on the road. Auto insurance…

- Young Driver Car Insurance Quote: The Ultimate Guide Being a young driver can be incredibly exciting, but it also comes with a responsibility to drive safely and legally. One of the most important things that you need to…

- About How Much is Car Insurance per Month IntroductionIf you own a car, you already know that car insurance is an essential expense that can't be avoided. While car insurance helps protect you financially if you're involved in…

- Cheapest Auto Insurance Near Me Are you looking for affordable auto insurance coverage near your location? In today's world, having auto insurance is not merely an option but a legal requirement. The right auto insurance…

- New York City Auto Insurance Rates The Basics of NYC Auto Insurance RatesNew York City is one of the busiest cities in the world, consuming a lot of time and energy to get around. With so…

- A Good Car Insurance Company: Everything You Need to Know IntroductionAre you looking for the best car insurance company? You have come to the right place. Finding a good car insurance company can be overwhelming, especially with the plethora of…

- Auto Insurance New York City: Protecting Yourself… Living in New York City, owning and driving a vehicle is a necessity for most people. Whether it's for commuting to work, running errands, or simply enjoying a weekend drive,…

- Cheap Car Insurance in Kent WA: Your Ultimate Guide Car insurance is a necessary expense for all drivers. Whether you’re a new driver or have been driving for years, car insurance is a must. It’s not only a legal…

- The Ultimate Guide to Fiat 500 Insurance The Basics of Fiat 500 InsuranceAre you a proud Fiat 500 owner? Then, you are probably looking for reliable insurance for your car. Fiat 500 insurance may seem like an…

- Check Car Insurance Coverage: Understand Your… Have you ever found yourself in a position where you were unsure if your car insurance would cover a certain event or situation? Car insurance is an essential investment for…

- tips for auto insurance ## Tips for Auto Insurance: What You Need to KnowAs a car owner, having auto insurance is a must. It not only protects you financially in case of an accident,…

- Utah Minimum Auto Insurance Requirements IntroductionAuto insurance is an important aspect of owning a car, and Utah state law requires drivers to carry minimum auto insurance coverage. Understanding the minimum requirements for auto insurance coverage…

- Car Insurance Quotes Springfield MO: Everything You… IntroductionCar insurance is a crucial aspect of car ownership that protects you financially in the event of an accident. In Springfield, MO, the legal minimum requirement for car insurance is…

- Auto Insurance in Panama City FL: Protect Your… IntroductionAuto insurance is a crucial aspect of owning a vehicle, no matter where you live. But in Panama City, Florida, a comprehensive auto insurance policy is even more important due…

- Auto Insurance for People Over 50: Everything You… IntroductionIf you are over 50 and looking for auto insurance, you might be wondering how to navigate this complex process. You may have heard that older drivers pay more for…

- Alaska USA Car Insurance: Protect Your Ride in the… The Importance of Car Insurance in Alaska USALiving in Alaska USA can be an exciting and thrilling experience, especially for those who love exploring nature and enjoy outdoor activities. However,…

- Auto Insurance York SC: Protecting Your Vehicle and… IntroductionAuto insurance is a necessity for anyone who wants to drive on public roads, and York, SC, is no exception. Whether you have just bought a new car or have…

- Auto Insurance Alabaster Al: Everything You Need to Know IntroductionAuto insurance is an essential requirement for all drivers in the United States. It provides financial protection against any damage or injury caused by you or your vehicle. Most states…

- Auto Insurance with Best Rates The Importance of Auto Insurance with Best RatesAuto insurance is a necessity for every driver on the road. It provides financial protection in case of accidents, thefts, and other unforeseen…

- Unraveling the Mystery of Bedford Car Insurance –… Are you a resident of Bedford and in search of the right car insurance for your vehicle? If yes, look no further as we're here to help. Purchasing car insurance…

- Everything You Need to Know About Car Insurance in… IntroductionCar insurance is a necessary expense for anyone who owns or operates a vehicle in Pocatello, Idaho. With so many options available, it can be difficult to know where to…

- Auto Insurance Albuquerque New Mexico: Guide to… Auto insurance can be a confusing topic for many people. There are so many different types of coverage, deductibles, and rates to consider. In this comprehensive guide to auto insurance…

- Auto Insurance Richmond: Everything You Need to Know IntroductionAre you a car owner in Richmond, Virginia, looking for the best auto insurance coverage at an affordable rate? Look no further! In this comprehensive guide, we will take you…

- Minneapolis Car Insurance Rates: Everything You Need to Know IntroductionFinding the right car insurance policy at a reasonable price can be a daunting task, especially in a big city like Minneapolis. With so many insurance companies and policies to…

- Phoenix Car Insurance Rates: Everything You Need to Know IntroductionAre you shopping for Phoenix car insurance rates, but don't know where to begin? Look no further! We've got all the information you need to make an informed decision about…

- Auto Insurance SR22 Quotes: Everything You Need to Know Are you in search of a reliable and affordable auto insurance policy that includes SR22 coverage? Look no further. In this comprehensive guide, we will cover everything you need to…

Interogator Blog teknologi gadget canggih terbaru

Interogator Blog teknologi gadget canggih terbaru